As 2025 dawns, investors face complexity shaped by geopolitical shifts and evolving economic dynamics. With dramatic tariff proclamations by the incoming Trump Administration and a potential global slowdown, the 100+ below-the-radar countries known as Frontier Markets from Latin America, Asia, Africa, former Soviet Union, and the Middle East offer compelling investment prospects.

Understanding Frontier Markets

While sharing characteristics with the broader Emerging Markets universe, Frontier Markets are a smaller subcategory generally less integrated into the global economy with other informational, regulatory, and logistics hurdles. However, these very distinctions can provide significant upside. And with many inherent idiosyncrasies, this sector also may be less risky than what many investors believe.

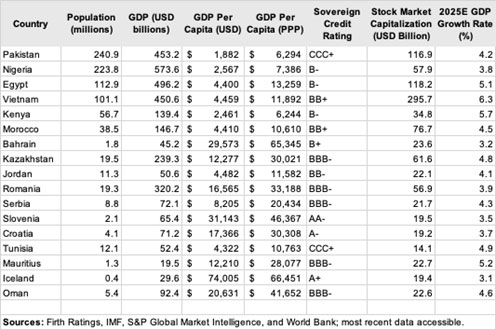

As Figure 1. below notes, Frontiers encompass a diverse group of nations with varying levels of economic development, market size, and sophistication: from some of the world’s poorest to some relatively high-income countries, with credit ratings from the lowest to even some surprisingly high in the AA range. Some have smaller populations of two million people, while others have greater than 200 million – which is more than double the size of the United Kingdom.

Figure 1. Select Snapshot of the Frontier Market Universe

While mainstream Emerging Market countries typically get ample coverage from Wall Street researchers, economists, and analysts, Frontier countries are often under-monitored, offering asymmetric advantages to managers who dig in deeper, analyze information more rigorously, and travel frequently to these exotic locales.

Offroad Investing

There are several reasons to consider Frontiers, many that echo old theses for larger Emerging Markets like Mexico and South Korea – countries that have effectively “emerged” – including:

- Faster Growth Potential: Many countries possess young, rapidly growing populations, a demographic dividend that can fuel economic expansion. As Figure 1. noted, most are projected to grow much faster than the US or Western Europe in 2025. These countries often have significant untapped potential for productivity gains and consumption growth as their middle classes expand. The combination of demographic tailwinds and economic development creates a unique environment for accelerated growth.

- Rerating of Financial Assets: Frontier Markets with improving fiscal management and sustainable growth prospects may experience credit upgrades and currency appreciation. This can lead to higher valuations for stocks and bonds, unlocking significant investor returns. As these markets mature and demonstrate economic stability, they become increasingly attractive to international investors seeking new opportunities. This attracts capital and allows local markets to broaden, deepen, and grow in a positive reinforcing cycle.

- Diversification Benefits: Due to their relatively low correlation with traditional asset classes, Frontier Markets can enhance portfolio diversification. As I’ve often said, the only thing that Paraguay, Pakistan, and Papua New Guinea have in common is they all begin with the letter P; their economies and financial markets are not intertwined in any material way. By investing in a variety of these countries, investors can reduce overall portfolio risk and potentially improve returns. This approach allows for exposure to economies that may not move in lockstep with more established markets, providing a hedge against global economic fluctuations.

Navigating the Frontier

While these countries offer promise, Investors must be prepared to traverse several key challenges accessing them including:

- Information Asymmetry:Limited data availability and transparency can make it difficult to accurately assess investments in some countries. These obstacles demand thorough research and often require on-the-ground expertise to truly understand the nuanced dynamics of these markets.

- Market Volatility:Frontier countries individually are often more volatile than developed ones, as well as subject to greater political risks, economic shocks, and currency fluctuations. The potential for significant price swings means investors must have a higher tolerance for risk and a longer-term investment perspective. Diversifying into many countries to reduce this risk is essential.

- Governance Risks:Regulatory frameworks may be less developed or inconsistent in some countries, posing headaches and headwinds for investors. Changes in government policies, legal uncertainties, and potential administrative hurdles can impact investment strategies and returns in Frontier Markets.

To mitigate these risks, investors – even large institutions – might consider dedicated funds that specialize in Frontier Markets. Expert managers can leverage their local knowledge to identify promising opportunities and manage risks effectively across dozens of countries. Professional fiduciaries often have established networks, a deep understanding of local economic conditions and logistics for investing in-country, along with the ability to conduct comprehensive analysis and due diligence that individual investors cannot do cost effectively.

Off the Beaten Path

Amid trade squabbles between the world’s largest economies, Frontier Markets represent a compelling, active opportunity for those seeking diversification. While the road to these Frontiers may be less traveled, the rewards for diligent investors could be substantial. The key lies in maintaining a balanced perspective – recognizing both their significant potential and their inherent challenges. For investors willing to do their homework and manage risks effectively, these countries offer a unique pathway to interesting return streams.

Dr. Peter Marber is Managing Director of Global Evolution, a leading asset manager focused on Emerging and Frontier Markets. A noted author, he also has served on the faculties of Harvard, Columbia, NYU, and Johns Hopkins.

The views and opinions expressed herein are those of the author and do not necessarily reflect the official policy or position of any organizations with which the author is affiliated. The content is intended solely for informational and commentary purposes and should not be interpreted as representing the views or endorsements of these entities.